DIOPTRA

DIOPTRA

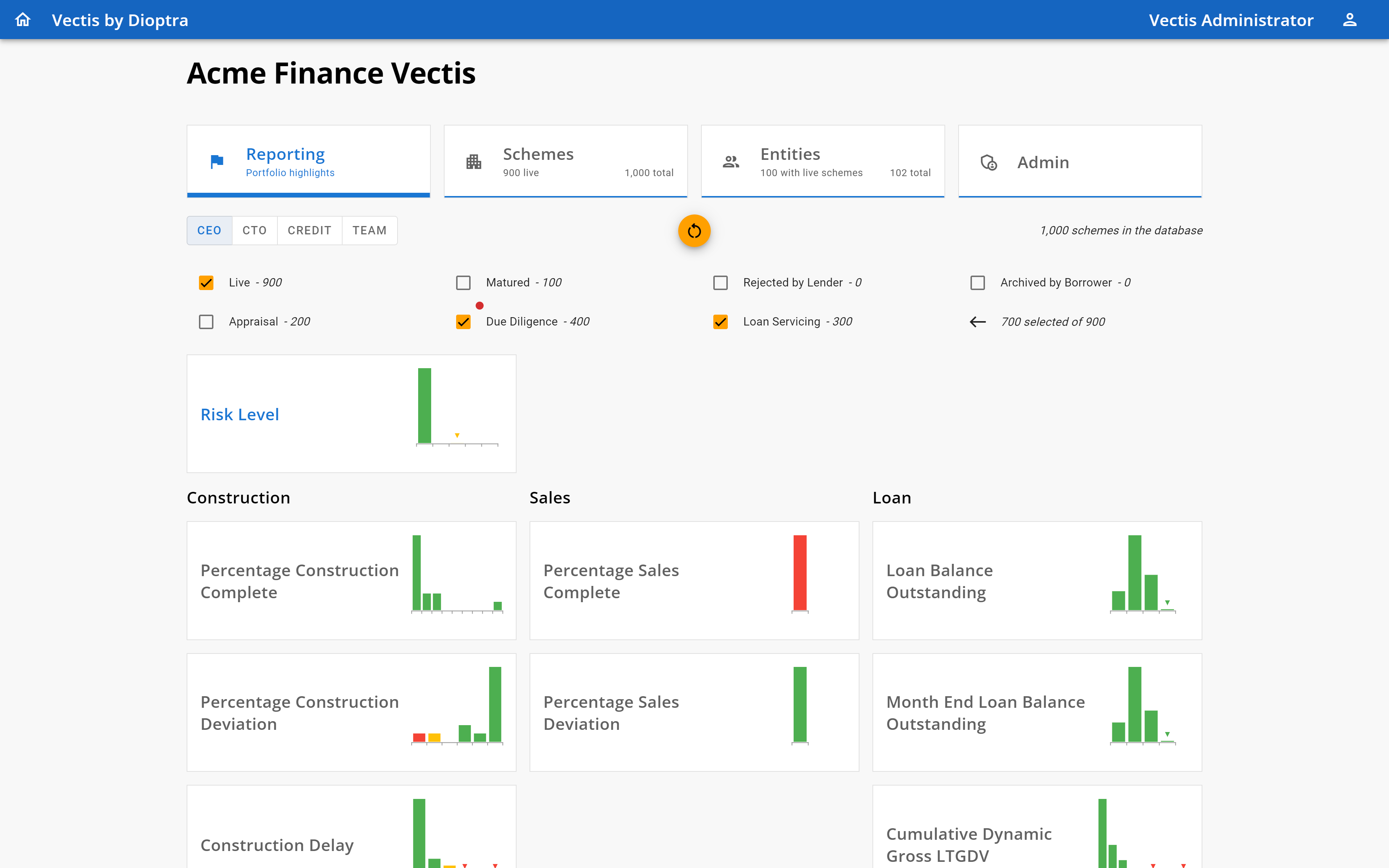

Dioptra's main screen layout

Forward looking investment analytics for institutional real estate investors

It's about fund equity

We have a capital markets mindset, focusing on fund equity. To analyse equity performance and risk, we accurately model all cashflow and finance contracts. We bring this analysis not only to individual assets, but to the whole fund portfolio.

What we'll do for you

Dioptra will dramatically improve your treasury, reporting and scenario analysis processes. No more low quality legacy systems or error prone spreadsheets.

Our first product is live

We launched Dioptra Vectis in mid 2021, managing a mezzanine and stretch senior development loan portfolio for Clearwell Capital. Vectis forecasts how actual cashflow divergence from budget is likely to raise portfolio risk and impair individual loans. Shortly this will extend to interest rate yield curve derived risk forecasts.

Exposing risk

We transform data into information to deliver insight. Dioptra looks for signals embedded in your cashflow that imply risk. As we develop a full fund management suite, we will assess direct risk by analysing past and current cashflow along with interest rate yield curve and option pricing. Indirect risk can be assessed from inflation swap yield curves and credit default swaps.

Revealing opportunity

Our fund management suite will have advanced what-if capabilities so you can compare diverse asset management options. For instance comparing the impact on fund equity of increasing CAPEX on a specific asset, versus divestment, versus doing nothing.

Modern technology

We run a modern technology platform with an intuitive user experience. Your users log in through a browser from any device and working from any location, always getting the same fast performance and high security.

Dioptra Vectis drives our loan book management and gives us an unparalleled insight into both individual loan and broad portfolio risks. No other loan system or real estate analytics provider we have seen comes close. Dioptra Vectis is by far the best property loan management platform that we have come across.

Ed Marley-Shaw, CEO Clearwell Capital

Work for Dioptra

We will soon be hiring technologists and financial analysts to dramatcally enhance our PropTech/FinTech enterprise SaaS product offering.